May 18, 2022

Vancouver, BC: Metallis Resources Inc. (TSX-V: MTS; OTCQB: MTLFF; FSE: 0CVM) (the “Company” or “Metallis”) is pleased to release its initial 3-dimensional (or “3D”) geological model, providing breakthrough insights into both the mineralized porphyry and enriched-gold zones at the Cliff-Miles Porphyry Corridor (or “Cliff-Miles”) lying within Metallis’ 100%-owned Kirkham Property (the “Property”), situated in the prolific Eskay Camp of the Golden Triangle, northwestern British Columbia. It is located approximately 30 km west of Seabridge’s world class KSM porphyry deposits, and Newcrest Mining’s producing Brucejack gold mine. The Golden Triangle is a district known worldwide for the past producing Eskay Creek and Snip gold mines.

Nickolas Dudek, Metallis’ Chief Geologist, stated “It is incredibly rewarding for the Company to achieve this critical milestone in the continued development of the Cliff-Miles porphyry corridor. Through this geological 3D Model, the team is finally able to highlight the true scale of the system and demonstrate the dominant controls on grade within the well-mineralized Medium-Grained Porphyry (“MP”) and the later gold-enriched zones. We are now also able to explain most of the copper/gold distribution at Cliff-Miles”. He went on to add “This year, the goal of the technical team is to evaluate and refine this updated geological model and utilize the information to guide us, through drilling, to increasing the average grade of the system.”

Model Highlights

- Metallis geologists have built a 3D model for each of the porphyry phases and gold-enriched zones at the Cliff-Miles to help demonstrate the distribution of high-grade intercepts;

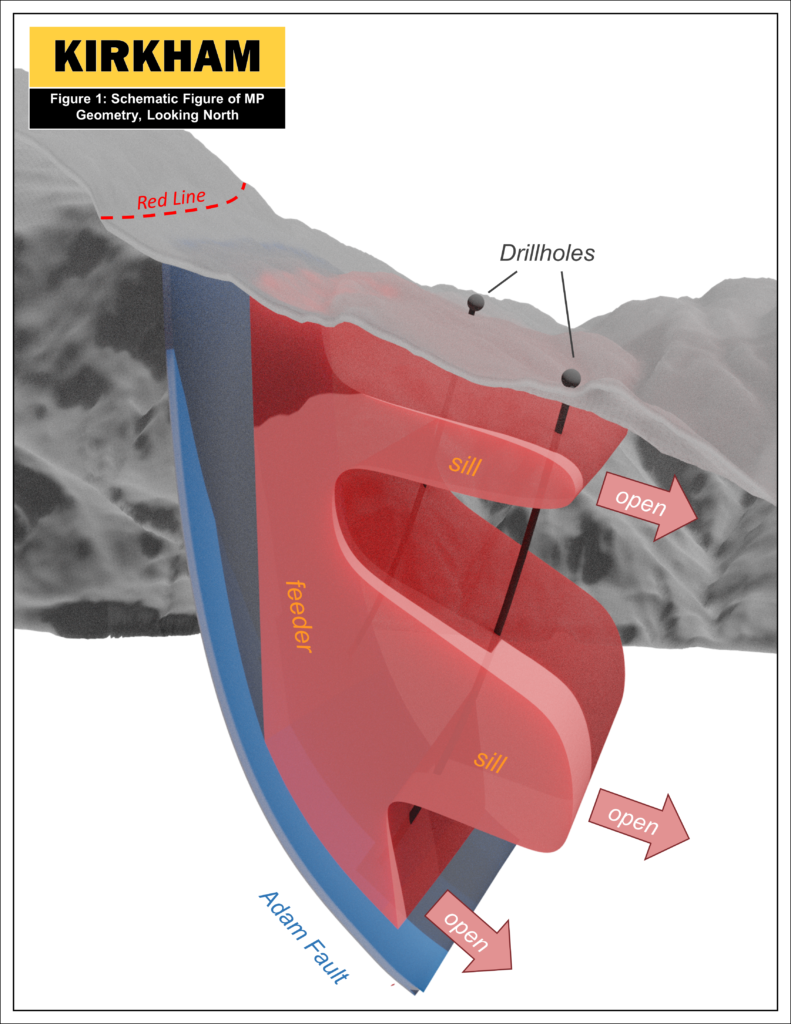

- The highest porphyry grades can be tied to a semi-continuous Medium-Grained Porphyry (“MP”) composed of a single dike-like feeder (or “trunk”) and two sill-like branches. These grades are found in the Southern end of the Cliff target (See Schematic Figure 1 Below); and

- The best gold-enrichment grades have a North-South trending and steeply dipping tabular form that runs along the East margin of the well-mineralized MP.

The current distribution of gold and copper mineralization is divisible into porphyry-related and late-gold related allotments.

Porphyry Cu/Au Mineralization

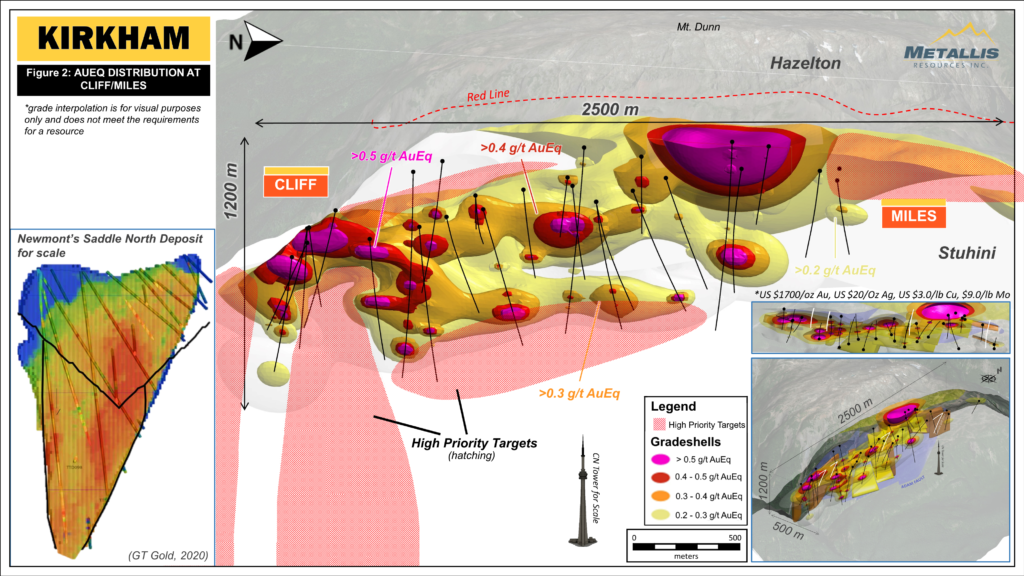

The MP porphyry phase, composed of feeders (dikes) and sill-like bodies, can be further subdivided into well-mineralized and poorly mineralized MP variants based on respective copper, molybdenum, and vein content (See Figure 2 Below).

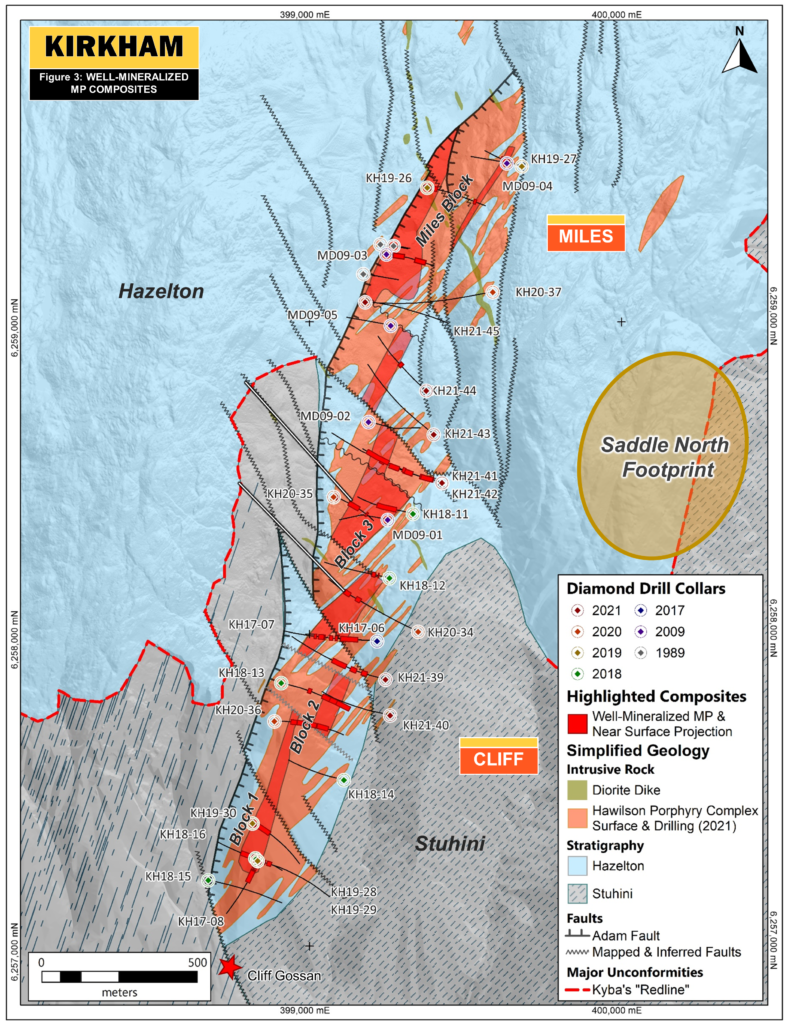

The feeder of the well-mineralized MP variant ranges between 20 meters (“m”) and 150 m thick, has only been tested as deep as 660 m below surface, and can be semi-continuously traced 2,500 m from far-south holes at Cliff all the way to the North end of Miles. Representative intercepts are listed below to show the dimensions of this very lengthy mineralized zone (See Figure 3 Below).

- Far-south Cliff example intercepts include 0.8 g/t AuEq* over 118 m in KH18-16; and

- Far-north Miles example intercepts include 0.34 g/t AuEq over 84.5 m in KH19-27 (located 2500 m to the north of Cliff)

The sub-horizontal sill-like geometries are most apparent between holes KH20-34 and MD09-05 and occur in two bodies:

- A semi-continuous shallow sill tracked over approximately 950 m from North to South and which is highly variable in thickness (70 m to 250 m thick). It is still open to the South (beyond KH18-13), to the East, and potentially to the North beyond MD09-03

- Example intercepts include 0.41 g/t AuEq over 80.3 m in KH17-07 or 0.32 g/t AuEq over 170 m in KH18-11

- A deeper sill tracked over 720 m from North to South, that pinches (>40 m) and swells (<170 m) along its length and is still open to the North (beyond KH21-42), South (beyond KH20-36), and to the East.

- Example intercepts include 0.36 g/t AuEq over 129.9 m and 0.37 g/t AuEq over 198.5 m in KH20-36, or 0.37 g/t AuEq over 193 m in KH21-42

Petrographic, geochemical, and geostatistical reviews are currently underway to establish new strategies to help the geological team distinguish this new well-mineralized MP variant in-field as well as to further refine the model. A simplified view of the grade-bearing MP model and how it fits with the gold-equivalent (“AuEq”) distribution can be seen in Figures 2 and 3. All the zones are still considered open to the North and South with multiple infill and extension opportunities situated near surface as well as at depth. All analytical data was completed at independent certified laboratories and have previously been reported.

Late Gold Mineralization

Though challenging to identify texturally, the gold-enrichment event can be empirically identified from high Gold-to-Copper ratios along with silicification and can be traced along the dominant structures of Cliff-Miles (Adam Fault and block faulting) (See Metallis News from February 1st, 2022).

The 3D model shows a North-South ribbon-like feeder, approximately 2,400 m long, present on the East margin of the newly identified grade-bearing MP and which extends across the Adam Fault (380 m to 830 m deep) into the graphitic siltstone footwall. Example intercepts include:

- North-South feeder example intercepts include 1.24 g/t AuEq over 32 m in KH20-37 and 0.33 g/t AuEq over 27 m in KH18-16

Alongside, loosely constrained, are the fault-bound Northwest-Southeast feeders.

- Northwest-Southeast feeder example intercepts include 0.63 g/t AuEq over 30 m in KH21-42

Additionally, two dominant stratabound mineralized zones can be partially traced from Miles South to Cliff.

- Stratabound mineralized zones identified at Miles include 1.05 g/t AuEq over 43 m in KH21-45 and 1.24 g/t AuEq in KH20-37; and

- At Cliff with 0.82 g/t AuEq over 32.4 m in KH21-40

*Gold equivalent (“AuEq”) grades are for comparative purposes only. Calculations use metal prices of US$1,700/oz gold, US$20/oz silver, US$3.0/lb. copper, and US$9.0/lb. Molybdenum. **Lengths are meters of downhole drilled core lengths. Drilling data to date is insufficient to determine true width of mineralization. Intervals are calculated using a notional cut-off of 0.20 g/t AuEq, a maximum of ten meters of internal dilution for porphyry-style mineralization and no top cut is applied. Recovery is assumed to be 100% as no metallurgical data is available.

Impact on Future Results

In addition to a better understanding of the grade-bearing MP, 3D models of the other MP variants, two phases of Course-Grained Porphyry (or “CP”), and multiple feldspar porphyry sills have been produced. The Company’s planned drilling this upcoming 2022 exploration season will focus on targeting the grade-bearing MP variant and gold-enriched mineralization with systematic step outs and undercuts, with a view to constraining geology and orientations, and avoiding the now identified and historically-poorly mineralized CP phases.

Qualified Person

David Dupre, P.Geo, Vice President – Exploration and the Qualified Person, as defined by National Instrument 43-101, has reviewed, and approved the technical information contained in this release.

About the Kirkham Property

The wholly owned 106 sq. km Kirkham Property is located about 65 km north of Stewart, B.C., in the heart of the Golden Triangle’s prolific Eskay (Sulphurets) Camp. The Property is prospective for multiple mineral deposit types and is located along a strategic geological boundary – the “Red-line” exposed on the Western margin of the Eskay Rift system in the Golden Triangle, Northwestern British Columbia.

The Kirkham Property is contiguous to Garibaldi Resources Corp.’s E&L Nickel Mountain Project in the North and Eskay Mining Corp. to the East. The property is within 12 km of the Eskay Creek mine while the Eastern border is within 12 – 20 km of Seabridge Gold’s KSM deposits and Pretium Resources’ Brucejack mine.

About Metallis

Metallis Resources Inc. is a Vancouver-based company focused on the exploration of gold, copper, nickel, and silver at its 100%-owned Kirkham Property situated in northwest British Columbia’s Golden Triangle. Metallis trades under the symbols MTS on the TSX Venture Exchange, MTLFF on the OTCQB Exchange, and 0CVM on the Frankfurt Stock Exchange. The Company currently has 52,839,878 common shares issued and outstanding.

On behalf of the Board of Directors:

/s/ “Fiore Aliperti”

Chief Executive Officer, President, and Director

For further information:

Tel: 604-688-5077

Email: info@metallisresources.com

Web: www.metallisresources.com

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Press Release may contain statements which constitute ‘forward-looking’ statements, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities and operating performance of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities or performance and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements because of various factors. Such risks, uncertainties and factors are described in the periodic filings with the Canadian securities’ regulatory authorities, including quarterly and annual Management’s Discussion and Analysis, which may be viewed on SEDAR at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected.

Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as intended, planned, anticipated, believed, estimated, or expected. The Company does not intend, and does not assume any obligation, to update these forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX-V Stock Exchange has neither approved nor disapproved the contents of this news release.